Ready to Be Free of Vision Insurance?

Let's talk about how your practice could thrive.

Vision Insurance is Holding Your Practice Back: Here's Why

- Matt Rosner, Director of Growth

Dr. Jones slumps at her desk at the end of another long day. It’s the third in a row with upwards of 25 patients, and she’s been unable to spend more than 15 minutes with any of them. Like many eye care providers (ECPs), she's stuck on the hamster wheel of vision insurance, delivering care under the tight grip of the big providers. Sound familiar?

Dr. Jones isn’t real, but her story plays out in real practices every day: Once, vision insurance was the safety net for both patients and doctors. Now, it's a net that's tangling more than it's catching, with its benefits unraveling rapidly.

Perhaps you've thought about cutting ties with insurance panels before. If nothing has improved, isn't it time to explore your options?

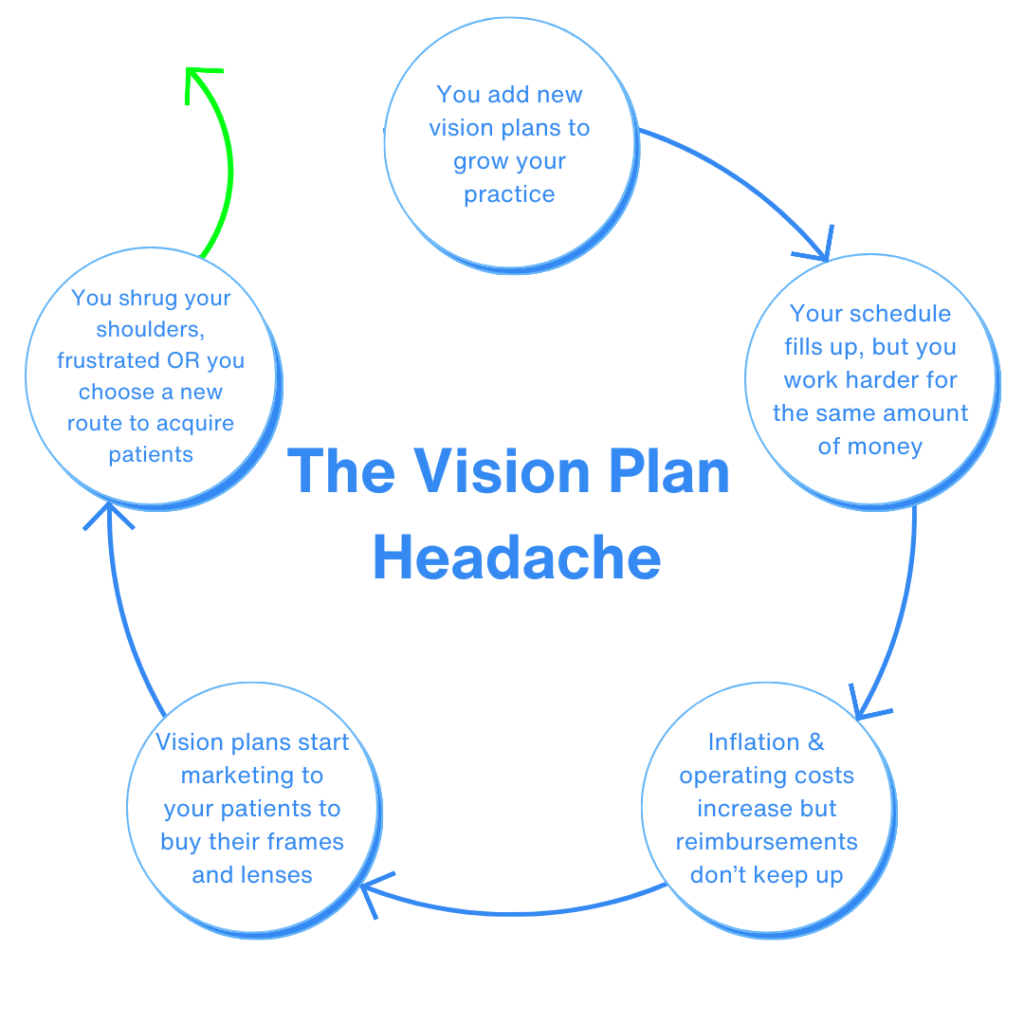

The Vision Insurance Headache

As Dr. Jones flips through another stack of denied claims, she can't help but recall the promise of 'comprehensive care' that vision insurance once boasted. Now, she's neck-deep in paperwork, fighting for reimbursements that barely cover the costs of the tests she's already performed. It's not the vision of care she dreamed of in optometry school, where every minute spent battling paperwork is a minute stolen from patient care.

These are just a few of the challenges modern ECPs have with vision insurance.

Declining Reimbursements, Rising Costs:

Doctors often find that despite rising operational costs due to inflation, vision insurance fee schedules remain static. Any increases in reimbursements seldom match inflation rates, leading to minimal (or no OR negative) profit growth.

Additionally (without warning) industry regulators may withdraw codes for essential diagnostic services and products, compounding the challenge of generating revenue amid falling reimbursements.

An Investment in Cost, Time, and Labor:

Joining an insurance panel requires a major commitment of time and energy. It’s like running a marathon every day — except the finish line keeps moving further away (and there's no shiny medal waiting for you). The average practice spends three hours per day on billing and coding and staying compliant costs $40,000 per physician.

This means that staying in network with insurers isn’t just a hassle, it adds significant expenses to the already rising operation costs in a practice, often needing dedicated staff to handle this additional investment of time.

Vertical Integration, Less Control:

At the top, a web of hidden connections between large insurance providers, lens manufacturers, and top frame companies limit practice independence. When a practice signs, these specific lenses and frame lines are marketed over others, turning practices away from the best option for the patient to the most marketable one for the practice.

Simultaneously, insurers in many states can cap prices at will, pressuring eye care professionals (ECPs) to juggle between best lens designs and unique designer frame offerings and insurer-influenced products, often from businesses under the same corporate umbrella.

Ready to Be Free of Vision Insurance?

Let's talk about how your practice could thrive.

So, Should You Drop Managed Care? Here Are Your Best Options

Dr. Jones steps into her practice on a bright Monday morning, greeted not by the dread of insurance restrictions but by the prospect of genuine patient interactions. It's been months since she dropped the burdensome yoke of managed care, and her practice is thriving. She's now free to focus on patient relationships and innovative care without the dark cloud of insurance protocols looming overhead. The transition wasn't easy, but the renewed sense of purpose in her work is palpable.

Picture a day where the only fine print you read is on a takeout menu because you've ditched the policy jargon for patient care. Here are two routes that could get you there.

Become an “Open-Access Provider”

Bracing yourself to tell patients they need to file their own claims can feel like preparing to audition for American Idol when you’ve only ever sung in the shower — intimidating. But ask most of the practitioners who made the change and they’ll tell you how much their practice has improved by facing their fears!

Moving out of network for more and more services means less time spent on billing and coding and more flexibility for you and your team. You’ll be able to dedicate more time to the needs of your practice and use the cost savings to re-invest in your practice and increase compensation for your team.

Many open-access practices offer support and guidance to their patients as they get accustomed to submitting their own claims for processing — being with them every step of the way decreases the chances that they’ll get frustrated and look for a new provider that does take their benefits. And, there are web-based platforms like Anagram that enable practices to file claims from any insurer without the pains of staying in compliance with large insurance providers.

Explore a Move Toward Cash-Pay Specialty Services

If you’re looking for a way to see fewer insurance patients without stopping completely, adopting a unique, cash-pay specialty can be your best option. ECPs have found success differentiating their practices by building a dry eye practice, pivoting to fit more specialty contact lenses, or adopting another type of new service offering that allows you to become recognized for something other than seeing 20-25 patients per day for run-of-the-mill eye exams.

Once you’re earning revenue from a new specialty, you can convert more and more of your practice to focus on this area and reduce or eliminate your participation in in-network services.

NeuroVisual Medicine is a specialty that fits the bill for many practices. At least 20% of the world’s population suffer from dizziness, headaches, neck pain, and the other symptoms that come with binocular vision dysfunction (BVD), particularly subtle phorias. The NeuroVisual Medicine Institute (NVMI) trains practitioners to identify patients in need and empowers them to offer symptom relief with precision micro-prism lens technology.

Take the First Steps Toward Freedom from Managed Care

What many ODs won’t realize until they take action is that moving away from vision insurance doesn’t just mean freedom from hassle — it can mean a more rewarding workday, the ability to attract new patients from farther away while increasing loyalty with the patients you’re already seeing, and a significant increase in profit margin.

Ready to start exploring NeuroVisual Medicine as your potential first step towards freedom? Click below to set up a consultation.

Can you create an environment where innovation isn’t just a buzzword but a daily pursuit?

Looking to dive deeper into the world of associate empowerment? Want to explore a specialty that could launch both your careers into the stratosphere? Click below and let’s chat – your practice’s blockbuster season might just be a consultation away.